Bringing a new medical device, including in vitro diagnostics (IVDs) or digital health, to market is never simple. Even the strongest technologies can stall when the regulatory pathway appears unclear or confusing. For early-stage innovators, navigating these steps alone can feel overwhelming, and choosing the correct regulatory approach is often the difference between an innovation reaching patients or disappearing before it ever has the chance.

Over the past several years, CPI has helped change that picture.

Through two major UK programmes, the Health Technology Regulatory and Innovation Programme (HealthTRIP) and the MedTech Accelerator: Rapid Regulatory Support (MARRS), CPI has directly supported over 400 companies across the UK in overcoming regulatory barriers, building stronger evidence, and even launching products into the UK and overseas markets. We also indirectly supported many more organisations through training and thought leadership, including policy recommendations that have become reality.

Together, these programmes give CPI detailed insight into the challenges innovators face and the type of targeted support that unlocks progress.

HealthTRIP: breaking down barriers for 277 innovators

HealthTRIP was created with a single aim: to help UK HealthTech SMEs meet medical device regulatory requirements in a rapidly changing landscape. Funded by Innovate UK and led by CPI in partnership with the Association of British HealthTech Industries (ABHI), the programme offered non-dilutive grant funding and nationally accessible training.

In total, 277 UK companies received grants of up to £30,000, enabling them to access tailored regulatory support, including regulatory strategy, classification advice, quality management system implementation, clinical planning, development of technical documentation, conformity assessment guidance, and global registration support. This support helped both recertify existing products to keep them on the market and move new products through critical regulatory milestones.

HealthTRIP also delivered a comprehensive programme of free training for the wider ecosystem, which was accessed over 12,000 times. A series of webinars covered classification, clinical expectations, risk management, post-market surveillance and more, supported by live Q&A sessions with regulatory specialists.

Reports

Alongside the training and grant support, CPI and ABHI gathered insight from more than 350 SMEs and HealthTech stakeholders. This work resulted in four national reports:

Challenges and opportunities for the UK HealthTech industry.

This report outlined systemic barriers, including regulation, but also highlighted other challenges, including investment, sustainability, supply chain and technology development.

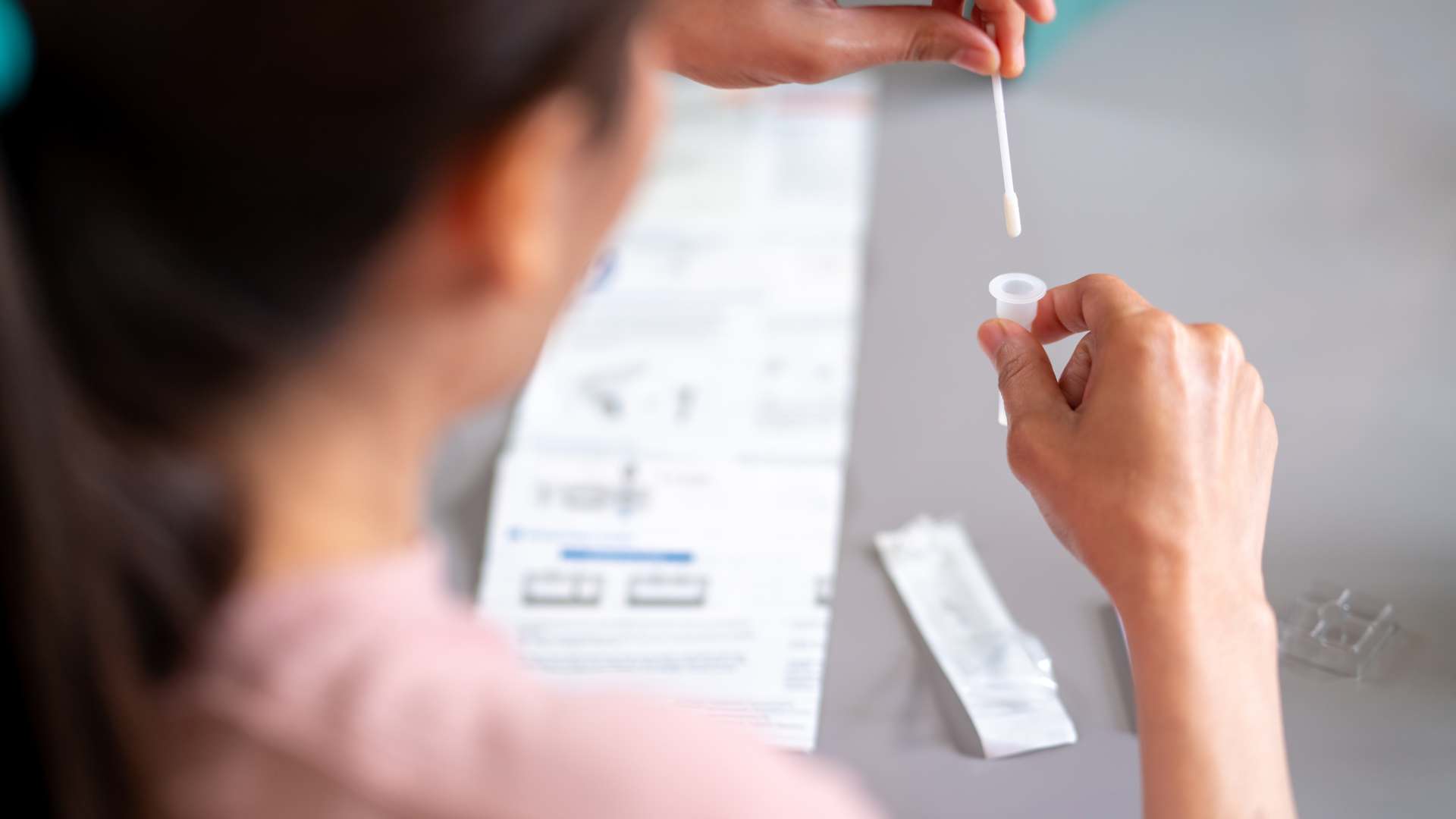

A strategic technology roadmap for the UK IVD industry.

Based on engagement with more than 150 organisations, this report identified nine key technologies and how the UK can strengthen capability and global competitiveness in next-generation diagnostics.

Challenges and opportunities for UK HealthTech manufacturing scale-up.

This report examined in greater detail the challenges companies face in establishing their manufacturing process, including the complexity of the challenge, finances, availability of a skilled workforce and national capability gaps.

An action plan: Driving growth of the UK digital health industry.

It explores the regulatory, evidence and interoperability challenges facing software and AI-enabled technologies and sets out priority actions to strengthen the UK’s digital health ecosystem.

Each of these reports helped clarify the needs of a fragmented sector to policymakers and, crucially, made actionable recommendations on how to address the identified challenges across UK policy, funding, sustainability, skills development, supply chain improvement and routes to international markets.

Independent validation of impact

An independent evaluation by Urban Foresight confirmed the strategic and economic impact of the programme. Key findings included:

- 90% upskilled their employees, strengthening the UK’s regulatory and technical capability.

- Companies were able to retain products in the market, preventing withdrawal due to regulatory burden and ensuring they remained available to help patients.

- Companies launched new products into the UK, EU, US and other international markets as a direct result of the support received.

- The estimated cost savings for companies directly supported are between £13.6 million to £59.7 million over the next decade.

MARRS: further support for the HealthTech ecosystem

HealthTRIP provided further evidence of the scale of challenges faced by UK SMEs regarding the regulatory aspects of their innovations. The funding programme was oversubscribed, highlighting the significant demand for support among UK HealthTech SMEs across regulatory, market access, as well as scale-up.

CPI worked with the Office for Life Sciences (OLS) and presented a case that HealthTRIP filled a much-needed funding and thought leadership/policy recommendation gap. As a result, OLS then funded the MARRS programme.

MARRS again provided non-dilutive grants of up to £30,000 to help SMEs secure expert regulatory guidance, supporting 142 companies. Through this programme, we also engaged with the funded SMEs to gain an updated, detailed view of the regulatory challenges facing innovators in 2024 and 2025.

This engagement was complemented by wider ecosystem research, as we also surveyed investors, universities, NHS procurement leaders and technology transfer offices. By combining SME-level insight with wider consultation, MARRS provided an updated, 360-degree view of the UK MedTech landscape, leading to these five key takeaways:

- Regulatory readiness remains a top barrier: Many SMEs lack internal regulatory expertise, leading to uncertainty and increased costs.

- CAB and MHRA engagement is challenging: Long response times and capacity pressures affect assessment timelines and market access.

- Evidence and testing pathways need earlier planning: Companies often underestimate the scale, cost and sequencing of evidence requirements.

- Universities and spinouts face translation hurdles: Academic teams often lack the resource or understanding to bridge from research to regulated product development.

- Investors prioritise regulatory clarity: Investors are increasingly risk-averse, but regulatory, commercial and market access clarity reduces some of that risk for them.

Reports

MARRS also focused in greater detail on the challenges companies face in investment, spinning out of UK universities, realising the promise of next-generation cancer diagnostics, moving diagnostic testing closer to patients, and in wound care. Here are the five national reports that explore these areas:

Challenges and opportunities for the UK MedTech SME ecosystem 2025.

Drawing on insights from 142 SMEs funded through MARRS, this report identifies the regulatory, evidence and commercialisation barriers most affecting early-stage innovators across the UK.

Turning innovation into impact: Removing barriers for MedTech spinouts in the UK.

Focusing on universities and technology transfer offices, this report outlines the translation challenges academic teams face, and the actions needed to strengthen spinout creation and commercial readiness.

Understanding investment barriers in the UK MedTech ecosystem.

A detailed exploration of why investors remain cautious about MedTech, highlighting how regulatory uncertainty, evidence expectations and NHS adoption challenges shape investment decisions.

Pre-competitive gaps in UK MedTech.

An analysis of critical capability and infrastructure gaps that hold whole sectors back – from testing and validation to scale-up – and proposes areas where coordinated national support would have the greatest impact.

Breaking through the barriers against next-generation cancer diagnostics.

A deep dive into the challenges faced by innovators developing advanced cancer diagnostics, highlighting technical, digital, and standardisation constraints and setting out a comprehensive plan for the UK to lead in this space.

What these programmes show about the UK’s needs and CPI’s role

CPI has now supported more than 400 SMEs through regulatory grant funding. This experience offers a clear perspective on what the UK MedTech ecosystem needs, the type of regulatory support required and how CPI can play a constructive role in meeting those needs.

CPI’s contribution is grounded in three areas:

- A detailed, evidence-based understanding of real-world challenges: Engagement with hundreds of innovators, investors, and system partners has revealed common barriers, including pathway uncertainty, documentation gaps, testing constraints, and evidence planning.

- Practical experience supporting SMEs at pace: Insight into over 400 regulatory support projects has provided CPI with valuable knowledge into how innovators work and where targeted interventions yield the most significant impact.

- The ability to convene national partnerships: By working with Innovate UK, OLS, ABHI, BIVDA, Cambridge Design Partnership, NHS partners, universities and investors, CPI helps build system-wide insight and connect organisations that may not otherwise collaborate.

The picture that emerges is not about CPI as the focal point, but about hundreds of innovators whose individual challenges might otherwise go unheard. By bringing these voices together, we have been able to identify common themes, amplify real-world barriers, and translate them into practical recommendations that government and industry can act upon.

Looking ahead: building a stronger future for UK MedTech

The HealthTRIP and MARRS programmes demonstrate the value of targeted regulatory support. They demonstrate the impact of combining practical funding with engagement, as well as how confidence in the regulatory pathway enables companies to move more quickly and efficiently.

As the UK’s regulatory environment continues to evolve, CPI remains committed to supporting innovators in navigating complexity, building robust evidence, and bringing life-changing technologies to the people who need them.

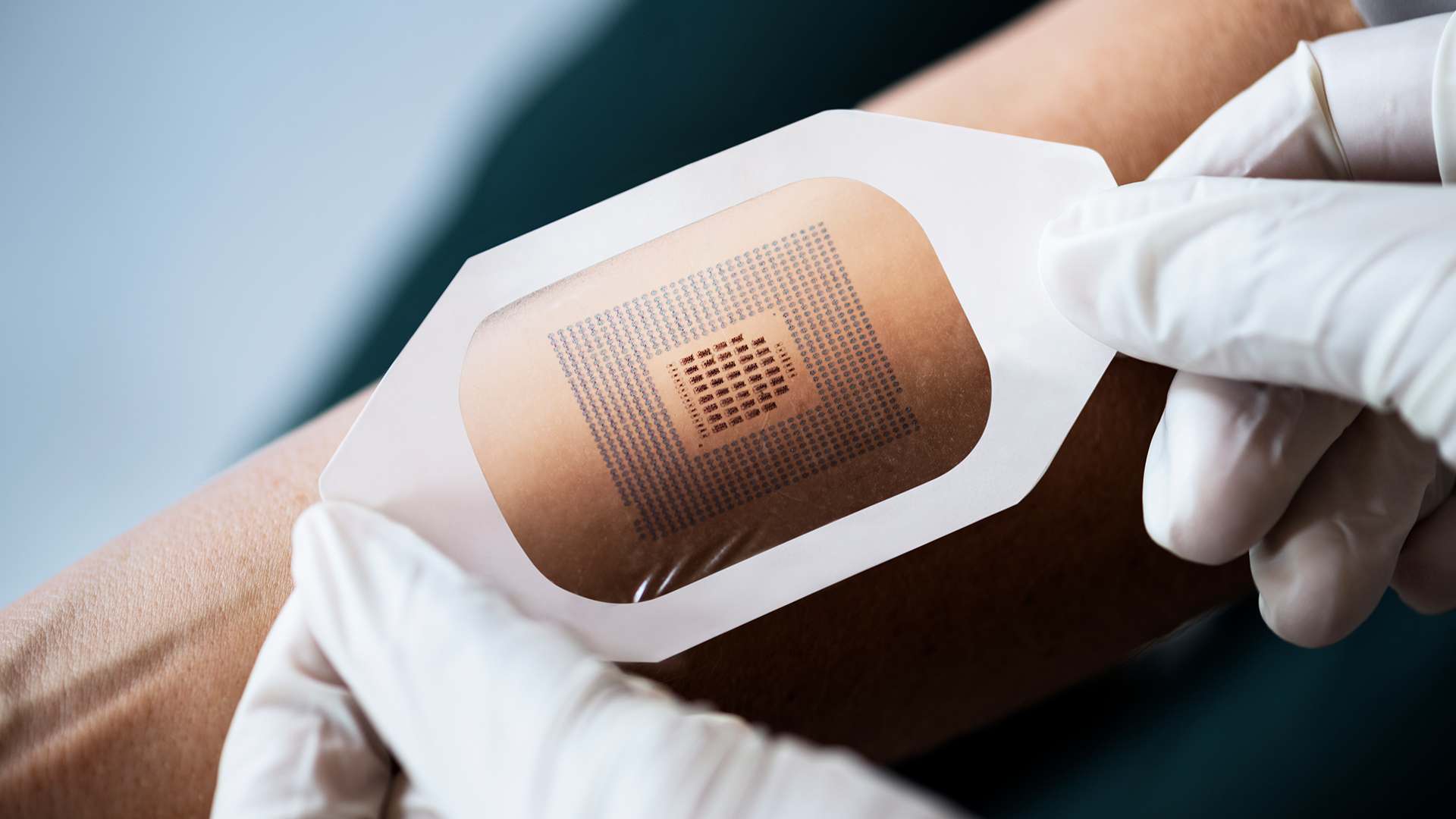

If you’re developing a medical device, especially in IVD (point of care and molecular diagnostics), patient monitoring and wearables, or wound care and drug delivery, and need help understanding your next regulatory step, fixing a deep scientific problem, or designing your next product, CPI is here to support you.

And a final word – if you have benefited from MARRS or HealthTRIP funding, found the reports interesting, benefited from some of the suggestions we’ve made (including NHS innovation passports and changed EIS and SEIS funding rules), shout out loud. Tell the UK Government how much this type of programme is needed. And talk to me. Let’s innovate together.

For more information

Enjoyed this article? Keep reading more expert insights...

CPI ensures that great inventions gets the best opportunity to become a successfully marketed product or process. We provide industry-relevant expertise and assets, supporting proof of concept and scale up services for the development of your innovative products and processes.